ESG

In-depth reporting on ESG investing for our pension fund and asset management readers from IPE’s award-winning journalists

Latest news

Northern Trust AM exits CA100+ and NZAM

The asset manager is the latest in a string of signatory departures from climate action groups, following BlackRock ditching NZAM earlier this month

Folksam, KPA set 2030 climate targets, highlighting social impact

Swedish pensions group and municipal pension fund subsidiary follow NZAOA requirements to establish 50% emission reduction targets for investment assets

German insurance association backs Commission’s plan for ESG omnibus package

‘We need sustainability reporting that focuses less on quantity and more on the quality of the information,’ says Jörg Asmussen, GDV’s chief

Brunel, NEST to help steer body eyeing ‘friction’ in UK equity markets

Investor & Issuer Forum to tackle contentious issues to enhance London’s equity market

IPE ESG Briefing: BlackRock exits NZAM

Plus: NZAM suspends operations; AP7 reviews BlackRock’s decision

Sustainable finance is braced for its toughest year yet

‘If ever we needed asset owners to be the drivers of responsible investment, it’s in 2025,’ says ShareAction’s Simon Rawson

UKSIF chief sees hope for further traction of UK anti-greenwashing measures

James Alexander, CEO of UKSIF, expects more asset managers to get authorisation for sustainable investment labels in 2025

IPE ESG Briefing: Environment Agency Pension Fund develops new RI policy

Plus: Aviva is fined for breaching SFDR; Swiss and Dutch schemes are more resilient to disruptive climate policies

Investors cautiously optimistic as US exits from Paris Agreement

Despite Trump’s decision, there are still attractive opportunities for those willing to invest with a long-term view, industry claims

Prospects for 2025: Pension investors identify risk scenarios

High equity valuations and a possible return of inflation, caused by geopolitical tensions and US policy, have European pension funds worried

ESG: Investors embrace new challenges on 1.5°C climate goal

The world has changed considerably since we first started publishing this annual special report in 2018, not least in that the rise of greenwashing concerns is leading to a phasing-out of terms such as ESG.

Pension funds outline progress towards net zero

Europe’s leading pension funds talk about their journey to net zero so far

- Previous

- Next

Sweden's buffer fund AP4 considers doubling allocation to defensive equities

An overhaul of buffer fund’s dynamic normal portfolio is already under way in a bid to adapt to greater global uncertainty

HypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

What happened at COP16?

Major deals were postponed at a UN summit as investors and the private sector busied themselves on the sidelines

A new perspective on credit for climate transition

Sustainable finance has turned out to be a much dirtier and grittier battlefield than early adopters and advocates projected it to be.

LeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

#10 Leaders in Investment podcast: Conversation with Professor Dirk Schoenmaker, Investment Committee Chair, PFZW

In Episode #10 of IPE’s Leaders in Investment podcast series, IPE Editorial Director Liam Kennedy interviews Professor Dirk Schoenmaker, Investment Committee Chair at Dutch pension fund PFZW

Have factor investing strategies had their day?

Factors have inspired indices, spin-offs and a variety of investment strategies but it has become hard to argue that they will offer investors a persistent future premium

Thematic investing set to morph into impact investing

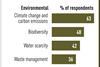

In the second article on a new survey, Vincent Mortier, Monica Defend and Amin Rajan argue that greater granularity in ESG investing is set to boost impact investing