Latest analysis

-

Analysis

AnalysisIPE DACH Briefing: Germany’s reform zeal to enter unchartered waters

Plus: SPRIN-D calls to deploy capital-funded pensions to support research and development projects; SPD wants to strengthen occupational pensions

-

Opinion Pieces

Opinion PiecesViewpoint: How a DB ‘surplus code’ could support economic growth

David Wrigley, partner at LCP, says supporting the appropriate release of surpluses could provide a shot in the arm to the UK economy

-

Analysis

AnalysisIPE ESG Briefing: BlackRock exits NZAM

Plus: NZAM suspends operations; AP7 reviews BlackRock’s decision

-

Analysis

Analysis2024: Achmea IM and BlackRock win Dutch fiduciary mandates

Last year, Achmea IM and BlackRock each won +€20bn fiduciary mandates from Dutch pension funds. This makes them the clear fiduciary winners of 2024.

-

Analysis

AnalysisIPE Nordic Briefing: Denmark’s PenSam boosts property portfolio

Plus: PFA Klima Plus generates high returns; NBIM pushes Council of Institutional Investors (CII) on unequal voting structures at companies

-

Analysis

AnalysisSustainable finance is braced for its toughest year yet

‘If ever we needed asset owners to be the drivers of responsible investment, it’s in 2025,’ says ShareAction’s Simon Rawson

-

Analysis

AnalysisWhat you need to know about the Dutch DC pension reform

January sees the first three pension funds transfer to a new DC-based accrual system in the Netherlands; others will follow over the next three years

-

News

NewsBumper month for EU sustainability policy ends with Transition Benchmark proposal

Platform on Sustainable Finance proposes two new Investing for Transition Benchmarks

-

Opinion Pieces

Opinion PiecesViewpoint: Trump’s SEC pick points to reduced proxy power for shareholders

With Paul Atkins as chair, the US regulator can be expected to roll back policies supporting ESG goals, according to lawyers at Labaton Keller Sucharow LLP

-

Analysis

AnalysisIPE DACH Briefing: Germany mulls over increasing security/defence spending

Plus: Bundesrat recommends reviewing second pillar pension system; Swiss Federal Supreme Court rejects complaints on pension reform

-

Analysis

AnalysisDutch doctors fund’s concentrated portfolio a ‘risky strategy’

The risk of missing out on new investment trends is seen as the main drawback of a concentrated portfolio with a buy-and-hold strategy

-

Analysis

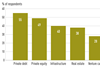

AnalysisDB schemes indicate growing preference for retaining assets

But buyout remains preferred option, according to UK pensions industry

-

Analysis

AnalysisIPE Nordic Briefing: Norway’s SWF calls for lift of general freeze on Russian assets

Plus: Clarity for Icelandic pension funds on legal situation around provisions for changed life expectancy; Sweden’s financial watchdog on increased pension transfers

-

Analysis

AnalysisIPE ESG Briefing: Environment Agency Pension Fund develops new RI policy

Plus: Aviva is fined for breaching SFDR; Swiss and Dutch schemes are more resilient to disruptive climate policies

-

Analysis

AnalysisGerman occupational pension schemes gear up for 2025

Pensionsfonds continue to be one of the most preferred vehicles for companies to outsource direct pension promises

-

News

NewsReputational disaster or ‘badge of honour’? Fund managers split over Aviva’s SFDR fine

Asset manager is first to face enforcement under the rules, but peers are divided on what it means

-

Analysis

AnalysisIPE UK Briefing: Consolidating LGPS assets and DC funds into 'megafunds'

Plus: British Growth Partnership; Innovation in BPA market

-

Analysis

AnalysisEurope must prepare for a China after Xi Jinping

Whatever the big issues of the 21st century, whether climate change, the environment, restoring economies post-COVID, fighting poverty or ending the war in Ukraine, they are much easier to resolve if countries work together.

-

Analysis

AnalysisIf UK defined contribution is ‘broken’, could collective DC be the answer?

Collective DC is emerging in the UK but time will tell whether employers will embrace it

-

Analysis

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors