Top stories

Dutch pension giants post solid 2024 returns despite bond market headwinds

Strong equity market returns more than compensated for capricious returns on bonds

UKSIF urges government to incorporate net zero transition into growth plans

UKSIF CEO James Alexander speaks out after UK chancellor Rachel Reeves says that the pursuit of growth ‘trumps’ the government’s net zero commitments

TNFD nets multi-year funding from Rockefeller, adds sectors

Rockefeller Foundation to join Stewardship Council alongside other funding partners of the Taskforce

People moves: Van Lanschot Kempen adds to fiduciary management team

Plus: BTPS appoints trustee director; Icelandic scheme appoints chief financial officer

No surprise as UK government keeps auto-enrolment threshold frozen

£10,000 minimum threshold has been in place since 2014

Investors cautiously optimistic as US exits from Paris Agreement

Despite Trump’s decision, there are still attractive opportunities for those willing to invest with a long-term view, industry claims

Northern Trust AM exits CA100+ and NZAM

The asset manager is the latest in a string of signatory departures from climate action groups, following BlackRock ditching NZAM earlier this month

PrevAer shifts to multi-asset strategy

Eurizon will run the strategy across the scheme’s three sub-funds through Alternative Investment Funds

Folksam, KPA set 2030 climate targets, highlighting social impact

Swedish pensions group and municipal pension fund subsidiary follow NZAOA requirements to establish 50% emission reduction targets for investment assets

German insurance association backs Commission’s plan for ESG omnibus package

‘We need sustainability reporting that focuses less on quantity and more on the quality of the information,’ says Jörg Asmussen, GDV’s chief

Iceland’s pension funds post 6.5% real return in 2024

Almenni Pension Fund sees mixed outlook, with uncertainty around global impact of new US regime, while earthquakes in Iceland may blight domestic economy

People moves: Van Lanschot Kempen adds to fiduciary management team

Plus: BTPS appoints trustee director; Icelandic scheme appoints chief financial officer

Swedish Pensions Agency’s analysis chief quits in row over ‘private commitments’

Ole Settergren to remain at the agency until a replacement takes over

People moves: Alecta poaches duo from AMF

Plus: Aviva Investors picks head of EMEA institutional client relationship management; Regeneration.VC adds partner, chief impact officer

The new face of Australia’s corporate super funds

Australia has seen the number of corporate pension funds shrink significantly over the years, but recent mergers with industry funds are giving new life to the sector

Could DB pension plans make a comeback in the US?

This year will see developments in the US DC market, but the renaissance of DB plans is set to continue

Future of ESG investing in doubt following decisive Trump victory

In the past two years, an anti-ESG backlash has grown strong roots on the American right.

IPE DACH Briefing: Germany’s reform zeal to enter unchartered waters

Plus: SPRIN-D calls to deploy capital-funded pensions to support research and development projects; SPD wants to strengthen occupational pensions

Viewpoint: How a DB ‘surplus code’ could support economic growth

David Wrigley, partner at LCP, says supporting the appropriate release of surpluses could provide a shot in the arm to the UK economy

IPE ESG Briefing: BlackRock exits NZAM

Plus: NZAM suspends operations; AP7 reviews BlackRock’s decision

2024: Achmea IM and BlackRock win Dutch fiduciary mandates

Last year, Achmea IM and BlackRock each won +€20bn fiduciary mandates from Dutch pension funds. This makes them the clear fiduciary winners of 2024.

AP7 boosts internal management as it reaches quarter-century milestone

Sweden’s DC buffer fund is boosting internal capacity and embarking on a hiring spree as it seeks to adapt to a harsh new investment environment

UKSIF chief sees hope for further traction of UK anti-greenwashing measures

James Alexander, CEO of UKSIF, expects more asset managers to get authorisation for sustainable investment labels in 2025

LeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

HypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

IPE Magazine December 2024

Read the latest issue of IPE Magazine

Browse the digital edition and find highlights from this month's issue below

Digital edition of IPE magazine

December Highlights

Europe must prepare for a China after Xi Jinping

Whatever the big issues of the 21st century, whether climate change, the environment, restoring economies post-COVID, fighting poverty or ending the war in Ukraine, they are much easier to resolve if countries work together.

If UK defined contribution is ‘broken’, could collective DC be the answer?

Collective DC is emerging in the UK but time will tell whether employers will embrace it

Insurance-linked securities bank a stellar year for returns

Insurance-linked securities (ILS) may be complicated, but they are gaining an institutional following especially among pension and sovereign wealth funds, multi-asset investment firms and endowments.

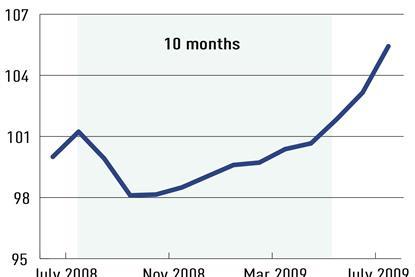

How pension funds manage derivatives and liquidity needs

The use of derivatives, for hedging and other purposes, is common among pension funds, but it can be a drain on liquidity. We asked three pension funds how they ensure adequate levels of liquidity when interest rates are volatile

Veritas: Finnish pension insurer seeks in-house efficiency

Veritas CIO Laura Wickström talks to Pirkko Juntunen about the challenges and opportunities of running a lean but efficient internal investment team

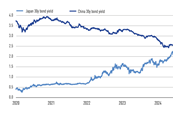

Fixed income, rates, currencies: Trump 2.0 sends global markets out of sync

Trump’s re-election prompted a rally in US assets, but elsewhere in global markets investors did not react positively

Briefing: The challenge of investing in Europe’s energy transition

The way the European economy powers itself is undergoing a fundamental shift, driven by market forces and policymakers. But while the direction of travel is clear, the path to a different energy mix is tortuous and the shift may be much slower than required to meet Europe’s target to be net zero by 2050.

- Previous

- Next

- Previous

- Next