All Features articles – Page 12

-

Features

FeaturesA broader view on corporate pension disclosures

What is not to like? Finally, a principles-based approach to the disclosures in financial statements that aims to cut the clutter and home in on the material that is truly material.

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Features

Features‘Painful’ private equity fees are hard to avoid

The Netherlands’ €551bn ($576bn) civil service scheme ABP paid a record €2.8bn in performance fees to private equity managers in 2021, prompting the fund’s president Harmen van Wijnen to announce an external investigation to assess ABP’s rising asset management costs. The €277.5bn healthcare scheme PFZW paid €1.26bn in performance fees to private equity last year, accounting for two thirds of total asset management costs.

-

Features

FeaturesCustodians will be key as investors move into digital assets

Digital assets may seem to be the latest investment trend, but institutions are taking their time in embracing them. Moving interest to the next level will require not only greater regulation but also a solid network of custodians to provide the required security and protection.

-

Features

FeaturesAsset owners need to find the best stock pickers

For pension funds, an asset manager search is a high-stakes exercise. Get it wrong and the scheme could be saddled with an underperforming manager for an extended period of time, dragging down returns and potentially impacting member outcomes.

-

Features

FeaturesAhead of the curve: solving the Russian share ban

Index investors inherently choose to follow the market through exchange-traded and index funds, but the recent prohibition on trading Russian stocks and their removal from global benchmarks has created something of a conundrum.

-

Features

FeaturesQontigo Riskwatch - July/August 2022

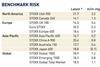

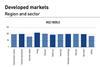

* Data as of 31 May 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

-

Features

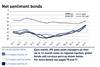

FeaturesIPE-Quest Expectations Indicator commentary August 2022

The war in Ukraine has reached stalemate. Neither party is capable of a surprise win, but time works against Russia. Can Zelensky keep the army motivated to continue? A long, hot European summer

-

Features

FeaturesYen’s swift dive surprises market

For several decades, the Japanese yen has not been in the limelight too often. However, earlier this year it became headline news as the currency began to depreciate rapidly against the US dollar. Although investors were not overly surprised that the yen would weaken, the speed of its decline was certainly startling. Over the course of about 15 months, between the start of 2021 to early April 2022, the yen has lost about 25% of its value against the dollar, with nearly half the move occurring in that final month.

-

Features

FeaturesUK DB schemes in a risk transfer sweet spot

Pension funds are in a good position for buyouts, but is there enough capacity in the market and will DB superfunds provide a genuine alternative?

-

Features

FeaturesFixed income, rates & currency: disappearing safe havens

Risk markets have been having a torrid time of late. ‘Risk-free’ government bond markets are not providing any safe havens in these storms, with curves steepening and considerable volatility in longer rates.

-

Features

FeaturesUK venture: new kids on the block

Google the venture firm 2150 and you won’t find an investment strategy but a manifesto.

-

Features

FeaturesResearch: beyond the net-zero hype

The exact path to a net zero world is unknown but the direction of travel is clear, argues Amin Rajan

-

Features

FeaturesAI could help triple Europe’s private debt market

Investors seeking higher yield have driven the growth of the private debt market. European private debt, though still much smaller than the US market, has also been growing rapidly. European lenders managed assets of $350bn as of June last year, according to Preqin, in a total market of $1.19trn. This is more than double the level in December 2016.

-

Features

FeaturesAhead of the curve: tie executive pay to climate targets

AllianzGI and Cevian Capital take very different approaches to how we manage equity portfolios, but we are both long-term and active owners of companies. Following a series of conversations about how to best implement ESG criteria in our portfolios, we have found a common perspective.

-

Features

FeaturesAccounting: IASB risks project duplication over sustainability

Looking back, the warning signs were clear. “The trustees of the IFRS Foundation are considering whether [we] should play a role in the development of sustainability reporting standards,” the March 2021 exposure draft explains.

-

Features

FeaturesEmissions reporting: taking stock of indirect emissions in Scope 3

Disclosure proposals by the US Securities and Exchange Commission (SEC) in March could guide the regulatory searchlight beyond companies’ direct and indirect C02 emissions (Scope 1 and 2) and towards upstream and downstream (Scope 3) emissions.

-

Features

FeaturesIPE-Quest Expectations Indicator commentary June 2022

The longer Russia refuses to make concessions, the more it loses, both in territory and in ‘face’. The Russian army has suffered even more loss of face than the Russian government. Analysts believe Europe and the UK now run the most risk. Perhaps, but in a post-war environment, they stand to gain most from reconstruction works in the Ukraine as well as the energy transition speeding up at home.