Asset Allocation – Page 7

-

Country Report

Country ReportSolvency rules continue to hamper Finland’s private pension funds

The Finnish retirement industry hopes that a relaxation of regulations will allow schemes to increase equity allocations

-

Special Report

Special ReportPension funds should seriously consider venture capital

To fulfil their role, pension funds would be well-advised to invest more in European private equity and venture capital

-

Country Report

Country ReportSweden’s AP7 adapts by expanding asset classes and boosting staff numbers

Under new leadership, Sweden’s default fund in the premium pension system is expanding asset classes and personnel

-

Features

FeaturesWhy investors should focus on Scope 3 emissions

The investment industry is preoccupied with reducing Scope 1 and 2 emissions in portfolios to meet net-zero commitments. However, this focus will not provide a way to effectively manage climate transition and physical risk.

-

Features

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Features

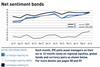

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

News

NewsAlternatives exposure drags on returns for Dutch metals schemes

PME has been increasing its exposure to private equity, real estate and forestry

-

News

NewsSwiss pension funds’ index investing climbs to all-time high

Swiss schemes achieved average net returns of 5.1%, with average returns of the best performing schemes standing at 8.2%, according to Swisscanto

-

News

NewsIceland’s Almenni sees Q1 global equity returns boosted by krona weakness

Pension fund reports local currency slide almost doubled foreign equity returns, while most domestic stock prices fell in first quarter

-

-

News

NewsPKBS drops ExxonMobil, Chevron, Glencore following oil and gas expansion deals

The pension fund has decided to implement an ESG index for investments in Swiss equities

-

News

NewsUK DB schemes concerned over increasing volume of regulatory pressures

Russell Investments research shows that DB schemes’ concerns over regulation have more than doubled since autumn/winter 2022

-

News

NewsDemand for equities double but infrastructure mandates fall, report finds

Infrastructure mandates for institutional investors saw a 15% fall in the last year

-

News

NewsKPN scheme dumps inflation linkers

The reason for the sale is Germany’s decision to stop issuing inflation-linked bonds

-

News

NewsBorder to Coast Pensions Partnership expands its private markets programme

Border to Coast Pension Partnership’s private markets programme has grown to £16bn following further commitments from its LGPS partner funds

-

News

NewsThinking Ahead Institute calls for investors to double stewardship resources

Report shows that industry average stewardship resourcing level is currently at around 5% of total investment management costs

-

News

NewsFondo Espero to review investment strategy to set up new sub-fund, life cycle option

Strategic realignment comes after introduction of silent-consent rule to tacitly join the scheme

-

News

NewsSwiss schemes turn to corporate bonds as currency hedging costs rise

Currency hedging costs in the bond markets US and EU government bonds less attractive for the pension funds, says Complementa

-

News

NewsPKBS cuts insurance-linked securities for fixed income, domestic property

teh scheme’s ILS active portfolio posted returns of -4.98% last year

-

News

NewsGermany’s BVK redefines macro allocations in new investment strategy

As part of its its strategic asset allocation, the fund plans to invest in timber looking at ‘evergreen structures’