IPE's EU Coverage – Page 8

-

News

Pensioenfederatie wants sustainability due diligence directive to include investors

The federation is rallying support for investors to engage with investee companies on human rights violations and environmental adverse impacts

-

Special Report

Special ReportBriefing – Regulation

In Frankfurt, EIOPA has responded to the European Commission’s call for technical advice in its stocktake on IORP II, the European framework for occupational pensions. EIOPA proposes widening the scope of IORP II in a pivot away from cross-border pensions and towards sustainability. A consultation process is open until 25 May.

-

Special Report

Special ReportRegulation: EIOPA takes stock of IORP II

Sustainability requirements in focus as EIOPA admits cross-border ‘failure’

-

Special Report

Special ReportRegulation: EC continues sustainable investment regulation drive

The state of play for EU sustainable finance regulation

-

Special Report

Special ReportRegulation: IPE’s guide to pensions regulation in six key European countries

IPE’s guide to pensions regulation in six key European countries. Gail Moss reports

-

News

NewsDanish pension funds laud EU red-tape cutting and urge EIOPA to follow suit

Crucial that business reporting provides value, says IPD

-

Asset Class Reports

Private debt: European markets try to power ahead

Private debt in Europe is still feeling the impact of the war in Ukraine and the surge in inflation, but there are reasons for optimism

-

Opinion Pieces

The cost of gender equality in pensions

The gender pension gap continues to be a significant issue in the European labour market, where women are at a disadvantage compared to men in terms of retirement income.

-

Features

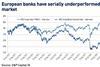

FeaturesFear and loathing in European banks

Any CEO would recognise there is a problem when investors do not want to put their money to work with you. That is the situation that European banks find themselves in. The MSCI Europe bank index has considerably underperformed its MSCI Europe parent over the last 10 years.

-

Features

FeaturesPensionsEurope: Not all doom and gloom for 2022

After the bumper investment returns of 2021 – the best that many pension funds had ever experienced – last year’s results were disappointing.

-

Asset Class Reports

Asset Class ReportsFixed income: Transition plans and green bonds

Should companies publish climate plans before they can issue green bonds?

-

Opinion Pieces

Opinion PiecesEuropean authorities must focus on derivatives risk

Opinions may differ on whether Brexit has had a positive or negative impact on either of the parties involved. However, it could be argued that an idiosyncratic event such as the liquidity crisis that took place in the United Kingdom at the end of September could have been averted, had the country been part of the bloc. Investors lost confidence in the UK government, now more isolated than before Brexit, and its ability to maintain its fiscal balance, after the announcement of a massive fiscal spending plan at the end of September. That sent yields on UK Gilts soaring and led to a spiralling lack of liquidity, as pension funds rushed to post collateral on their interest-rate derivative positions.

-

Opinion Pieces

Opinion PiecesGermany’s equity pension plan raises questions

The current legislative period could bring substantial changes to Germany’s pension system. The government is pursuing reforms to fund first-pillar pensions through a buffer fund invested in equities, although there is little consensus on its feasibility.

-

Features

FeaturesEuropean Commission announcement brings some clarity to derivatives clearing

Many unanswered questions linger after the departure of the United Kingdom from the European Union. However, a recent announcement by the European Commission (EC) promises to bring some much-needed clarity to the derivatives market.

-

News

PensionsEurope unsure EU will agree to ECB help in a pensions liquidity crunch

European pensions lobby chief expects more emphasis on liquidity risk management in future pensions regulation

-

Asset Class Reports

Asset Class ReportsAsset class report – Equities

Factor investment strategies were once the ‘new black’ - scientific, quant driven approaches that could deliver the ‘smart beta’ nirvana of lower volatility returns and optimised exposure to robust return premia from small cap, value and quality stocks. Pundits always warned adopters that not all factors would perform all of the time - and indeed they didn’t. But investors are taking a fresh look at factor strategies now the extended spell of outperformance of growth stocks has passed, and value has reasserted itself.

-

Special Report

Special ReportProspects 2023: How important are the carbon markets?

Carbon pricing is key to investment in green technology

-

Asset Class Reports

Asset Class ReportsEquities – Investing in the midst of Europe’s gloom

Healthcare and luxury brands are two sectors with potential to stand out in an otherwise gloomy macro environment

-

Opinion Pieces

Opinion PiecesDutch pensions reform: A never ending story

In the last two years, nearly all my contributions for this section have been about the ongoing reform of the Dutch pension system, which will involve the transfer of defined-benefit (DB) accruals to a defined-contribution (DC) setting.

-

Features

FeaturesEuropean pension dashboard in the starting blocks

The European Tracking Service for pensions has been years in the making but is now set for a rollout, to be completed by 2027