IPE's EU Coverage – Page 10

-

News

NewsPensionsEurope backs ‘high added value’ withholding tax action at EU level

Umbrella association responds to European Commission consultation

-

News

Commission grants final central clearing exemption for pension funds

Pension schemes will be expected to clear via EU CCPs, says Mairead McGuinness

-

Special Report

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.

-

Special Report

Special ReportTop 120 European Institutional Managers 2022

Total non-group assets managed for all types of European institutional clients – pension funds, insurance companies, corporates, charities and foundations – for the leading 120 managers in this business segment. Total assets are €14.4trn (2021: €12.2trn)

-

-

Special Report

Special ReportOutlook: Future of hydrocarbons

The OECD remains critically dependent on Russian oil and gas – and finding alternative sources will be very hard

-

Special Report

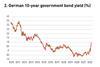

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

News

NewsEU securities watchdog delivers anti-greenwashing supervisory briefing

Briefing described as ‘to-do list’ for national supervisors on how best to deal with greenwashing in asset management

-

News

NewsDutch query EC due diligence proposal pension fund scope, fit

Pensioenfederatie calls for clarification and amendment of Commission’s proposed corporate sustainability due diligence directive proposal

-

News

NewsEFRAG flags SFDR PAI links in draft corporate reporting standards

Draft EU corporate sustainability reporting standards out for consultation

-

Opinion Pieces

Opinion PiecesRobust central clearing is critical for millions of Europeans

Derivatives like interest rate swaps are now a central component of risk management best practice. According to a 2018 paper by ISDA and PensionsEurope, the percentage of hedged pension liabilities in Denmark, the Netherlands and the UK ranges from 40-60% of total liabilities.

-

Opinion Pieces

Seesawing rates pivot European pension funding ratios

Many pension funds throughout Europe have had insufficient funding ratios for many years in part due to falling interest rates, even though pension funds’ investment choices and contribution levels also play a role.

-

Features

FeaturesInvestors grapple with sustainability in short selling strategies

The recent move by the EU to exclude derivatives from sustainable strategies has focused attention on the role of short selling in promoting lower carbon emissions

-

News

NewsEIOPA proposes new pensions info-gathering to close ‘important’ data gaps

Regulator says its capacity to analyse emerging risks is currently limited

-

News

EU institutions urged to mandate transition plans in final CSRD

Eurosif, PRI write to EU institutions as they negotiate over the corporate reporting directive

-

News

NewsEC follows through with derivatives exclusion in final SFDR RTS

Exposures through derivatives not allowed to be reported as sustainable elements of strategy

-

News

NewsEIOPA launches climate risk-focused 2022 pension fund stress test

Stress test also aims to assess the effects of a rise in inflation on retirement income

-

Asset Class Reports

Credit: EU raises the green bond stakes

The EU is considering making its Green Bond Standard mandatory

-

Features

The case for an EU consolidated tape

Liquidity. Equality. Fragility. With apologies to the French Republic, these three words almost act as a lodestone in discussions about a consolidated tape (CT) for EU securities. The need for such a tape is becoming more apparent than ever, but it could still be three years or so before it become a reality, according to Susan Yavari, regulatory policy adviser at the European Fund and Asset Management Association (EFAMA) and the author of a detailed official position paper on the subject published in mid-February.

-

News

Investor bodies join NGOs in call to MEPs to broaden scope of EU CSRD

Groups want Directive to include all listed SMEs as well as non-listed SMEs in high-risk sectors