Investment – Page 3

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Interviews

InterviewsThematics Asset Management’s CIO on themes and investment challenges

Out of the 19 boutiques businesses belonging to the Natixis Investment Management franchise, Thematics Asset Management is by no means the smallest, but it is not exactly a juggernaut, managing €3.3bn of assets at the end of last year. Yet, it is actively contributing to what could be a crucial evolutionary step for global investors.

-

Features

FeaturesModelling shows net-zero investing can be profitable

Since the acceptance of the Paris Agreement in 2015, which bound nations to a legal commitment to reduce global temperatures, there has been a clear shift towards net-zero investing. While socially responsible investments are crucial for the mitigation of climate change, recent calls to row back on ESG funds suggest some hesitation.

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

Asset Class Reports

Asset Class ReportsIs India’s equity market now the new China in investors’ eyes?

Better governance and a clear economic path may put India in the lead

-

Asset Class Reports

Asset Class ReportsA changing Saudi Arabia proves attractive for investors

Equity market is starting to open to investors as the country liberalises strict rules

-

Interviews

InterviewsMercer’s Rich Nuzum: soft skills are the hardest in investment governance

Mercer’s recent acquisition of Vanguard’s outsourced chief investment officer (CIO) business and its sale of two administration units points to changes in asset management as firms continue to focus on core activities.

-

Features

FeaturesIPE Quest Expectations Indicator - April 2024

The shadow of the US presidential elections is longer than normal because Trump is under several legal clouds. He could still get barred from participating but that seems unlikely. He does have a liquidity problem, a self-destructive streak, a mercurial character and no credible alternative waiting in the wings, though.

-

Features

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

-

Features

FeaturesInvestors are paying for hedge funds' reluctance to use hurdle rates

Although two years have now passed since the US Federal Reserve started rapidly hiking interest rates, the likelihood that your hedge fund manager will have a ‘hurdle rate’ – a minimum rate of return before performance fees kick in – has not changed. Only a quarter of hedge funds, by our count, have such a threshold in place and the practice does not yet show signs of becoming more widespread, even though the risk-free rate has now exceeded 4% for well over a year.

-

Features

FeaturesMeasuring the impact of non financial factors on GDP growth

In their paper entitled Modeling the Links Between Economic Growth, Socio-economic Dynamics and Environmental Dimensions: a Panel VAR Approach, the authors attempt to quantify direct and indirect causalities between economic growth and extra-financial dimensions, including demographics, biodiversity, climate change, political stability, inequalities and economic growth.

-

Features

FeaturesAn inflection point for India bonds

The impending inclusion of Indian government bonds (IGBs) in JP Morgan’s widely tracked $240bn (€220bn) Govern ment Bond Index-Emerging Markets (GBI-EM) index is seen as a milestone. However, while some asset managers hope it is the beginning of a more open investment culture, others are more circumspect.

-

Features

FeaturesIPE Quest Expectations Indicator - March 2024

Climate change is coming to a trend break as the low-hanging fruit has been picked.

-

Features

FeaturesSecuritised credit keeps on shining

For a market with a difficult past, some could even say an image-problem, securitised credit has been performing remarkably well in recent years.

-

Interviews

InterviewsMuzinich’s Tatjana Greil Castro on credit fundamentals

In one of the meeting rooms of the London office of Muzinich & Co are displayed a series of bond certificates from the past.

-

Features

FeaturesContrasting global economic growth fortunes

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.

-

Features

FeaturesAI’s future in investment management is evolutionary

The explosion of ChatGPT-style large language models (LLMs) has ignited a heated debate over the future of artificial intelligence (AI) in investment management and its role in institutional investor portfolios. However, amid the noise, a groundbreaking application of AI has quietly arisen, which has the potential to revolutionise the industry.

-

Features

FeaturesA bumper year for convertible bond issuance

The convertible bond market ended 2023 on a strong note with its main index – the Refinitiv Global Focus – returning 6% in the fourth quarter. The optimism has continued into 2024 on the back of reasonable valuations, historically low equity volatility and better opportunites.

-

Features

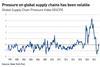

FeaturesConflict and elections set to dominate the investor landscape

Middle Eastern tensions are running high, with violence flaring up across the wider region. Combined with the ongoing attritional destruction in Ukraine, this is impacting world trade, and it seems certain that international conflict will continue to be a source of great concern in 2024.

-

Features

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs