Investment – Page 8

-

-

Features

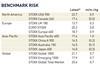

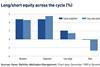

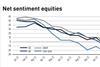

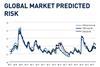

FeaturesQontigo Riskwatch - February 2023

*Data as of 30 December 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesEuropean Commission announcement brings some clarity to derivatives clearing

Many unanswered questions linger after the departure of the United Kingdom from the European Union. However, a recent announcement by the European Commission (EC) promises to bring some much-needed clarity to the derivatives market.

-

Features

FeaturesESG: Germany’s energy options

The country’s reliance on Russian gas means its change of energy sources will carry a larger environmental cost

-

Interviews

InterviewsNewton’s Euan Munro: Seeking the best of both worlds

Euan Munro has built a formidable reputation in asset management, developing a major multi-asset absolute return strategy at Standard Life Asset Management in the 2000s. But the fortunes of his once mighty Global Absolute Return Strategy (GARS), now managed by Abrdn, have wavered as multi-asset strategies have fallen out of favour.

-

Features

FeaturesAhead of the curve: Is small cap the next mean reversion trade?

By now, most investors have noticed a rebound in value relative to growth in equity markets. After underperforming growth over the past decade, value stocks are experiencing strong mean reversion and outperforming significantly.

-

Features

FeaturesIPE Quest Expectations Indicator - January 2023

Better air defence and the ground freezing over are steadily improving the outlook for Ukraine’s forces, now locked in stalemate. A series of blunders haunts US Republicans in general and Trump in particular. If Biden’s stimulus package is enacted, it will counteract Fed policy, possibly prolonging the series of interest rate increases. The EU seems to have bought too much gas. It has agreed to take border measures against some products from climate change laggard countries.

-

-

Features

FeaturesQontigo Riskwatch - January 2023

*Data as of 30 November 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Interviews

InterviewsMirova’s Philippe Zaouati: realistically optimistic

Asset management CEOs tend to be a clever bunch, but there cannot be many who are familiar with the work of Antonio Gramsci, the 20th century Italian socialist philosopher.

-

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.

-

Features

FeaturesUK fiduciary managers wrangle with LDI fallout

UK Gilt yields rose throughout 2022, even before September’s well-publicised spike caused by the unfunded mini budget. Fears of global inflation, exacerbated by the energy crisis and geopolitical uncertainty following Russia’s invasion of Ukraine, took UK 10-year yields from around 1% in January to 3% in mid-September.

-

Features

FeaturesAhead of the curve: Recalibrating alternative allocations for a new market

Geopolitics, inflation, and central bank policy have agitated financial markets in 2022, leaving returns and diversification in short supply. A comparison of global equities and bonds provides a sense of just how challenging the results have been.

-

Features

FeaturesIPE Quest Expectations Indicator: December 2022

The Ukrainian offensives look to have petered out and a new initiative will be needed to maintain morale. The US government is once again gridlocked and another debt ceiling fight is likely. The EU seems ready even for a harsh winter, but there are signs of war fatigue. In the UK, Prime Minister Rishi Sunak has apparently learned from the Liz Truss debacle, quickly making the necessary political U-turns, in particular on climate change. Expectations for the COP27 meeting in Sharm El-Sheikh were low. Analyst views indicate increasing belief that the wave of interest rate increases is receding.

-

Features

FeaturesQontigo Riskwatch - December 2022

*Data as of 31 October 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesThe rising influence of target-date funds on capital markets

One of the fastest growing markets in recent years is the US retirement market. Since 1995, the investment volume has increased six-fold, so that by the end of 2021, the market stood for almost $40trn (€40.1trn) AUM.

-

Features

Features17Capital’s Pierre-Antoine de Selancy: Navigating NAV lending

Pierre-Antoine de Selancy has just left a meeting with his company’s new majority shareholder, Oaktree, and is running a little late. His days are busy. De Selancy is founder and managing partner of 17Capital, a London-based boutique specialised in providing NAV finance to private equity managers.

-

Features

FeaturesUK sovereign debt in turbulent waters as challenges remain

The buttoned-up Gilts market has never seen or done anything like it. Trusty stalwart of liability matching for defined benefit (DB) pension schemes, the blue-chip security has already poleaxed a British chancellor of the exchequer just a month in office, and has effectively done the same to prime minister Liz Truss.

-

Features

FeaturesAhead of the curve: Beefing up guardrails as risks rise in private credit

For US and European private credit firms, storm clouds are gathering.The recent rate hikes by the Federal Reserve, European Central Bank (ECB) and the Bank of England (BoE)have numbed activity in the leveraged loan and high-yield spaces.