Government Bonds – Page 9

-

News

NewsFTSE Russell finalises fixed income country classification framework

Index provider sets out guidelines for government bond indices, launches Chinese green bond index

-

News

NewsFitch launches ESG credit rating ‘relevance’ scores

Data published to enable investors to ‘agree or disagree’ with impact of ESG issues on credit ratings

-

Features

FeaturesFixed income, rates, currencies: Hope but also fears for 2019

US domestic investors hold healthy stock market profits after a decade-long bull run Geopolitics on many fronts point to tumultuous times ahead

-

Features

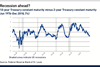

What next for US Treasuries?

A consensus on the direction of 10-year US Treasury rates is not obvious, because the answer reverts to a further question: whose consensus? Strategists, economists and other informed professionals have a particular view. The market itself, however, expresses a more diffuse and different opinion.

-

Features

Fixed income, rates, currencies: Challenges still lie ahead

While the US mid-term elections saw the Democrats regain the House of Representatives, trade policy remains in the hands of the White House. Trade tensions, between the US and China in particular, will remain to the fore. President Trump’s aggressive trade policy is already having a global impact with declining purchasing manager indices indicating corporate hesitation in future plans.

-

News

NewsAP2 predicts boom in public sector green bond issuance

Dutch regulator also notes growth of green bond asset class

-

News

UK asset management body calls for bond market data boosts

Proposals formulated in light of best execution requirement under MiFID II

-

News

Netherlands to be first AAA-rated issuer of green bonds

Annual amount expected to be between €3.5bn and €5bn

-

News

ATP nets DKK3bn profit from private equity holdings in 2018

US bond losses in third quarter dented year-to-date investment profits for Danish fund

-

Analysis

AnalysisAnalysis: European Commission rejects Italian budget plan

Italy’s government is intent on keeping its budget promises after the European Commission rejected its draft plan, writes Carlo Svaluto Moreolo

-

News

FTSE Russell predicts $10bn inflow when A-shares join indices in 2019

Chinese government bonds could be added to leading fixed income benchmarks following review of classification criteria

-

News

‘Too big to ignore’: The rise of China’s $12trn bond market

$48bn invested in Chinese government bonds in H1 2018 – nearly double the total for the whole of 2017

-

News

Italian pension funds cut bonds in diversification push

Occupational and personal fund investors have reduced holdings in government debt

-

News

Philips scheme cuts government bonds to benefit from rising rates

Strategic divestment comes at the expense of euro-denominated government paper

-

Asset Class Reports

Comeback trail

Greece has come a long way since the turbulent summer of 2015 but it still looks vulnerable as the end of its bailout looms

-

Asset Class Reports

Government Bonds: Attractions on both sides of the pond

US Treasuries have slumped in value but still have the allure of a safe haven

-

Asset Class Reports

Euro-zone: What comes after QE?

The euro-zone is on an exit route from quantitative easing

-

News

ECB signals end to QE but interest rates to stay low

Bond-buying programme will shrink to €15bn for last three months of the year before ending in December

-

News

NewsUK considers scrapping ‘controversial’ inflation measure

Abolishing retail prices index could cut scheme liabilities but legal problems could scupper changes

-

News

Securitised sovereign bonds ‘could help increase financial stability’

Economic professor sees demand from insurance industry, but major opposition remains